Customer Nancy Tryon:

“Thank you…your work is a necessity…”

Questions? Then, call us toll free at: 1-888-968- 8654

(product can be removed later)

Price: $249.95

My name is Darius M. Barazandeh, I am a JD and real estate investor.

I have designed the Attorney’s Secrets To Investing in Tax Lien Certificates™ to teach you how to safely invest in tax lien certificates. Purchasing tax liens from county and municipal governments can provide you with extremely high rates of return ranging from 12%, 15%, 24% or even 1000% or more per year. Unlike a stock market purchase, when you purchase a tax lien certificate you don’t need to worry about sudden changes in the market. Rather you become a lien holder with powerful legal rights. You will either earn a fixed and stated return on each dollar invested or you can foreclose and take title to the real estate backing the certificate. No matter how well the stock market is doing, careful investment in tax lien certificates will allow you to consistently out-perform the stock market.

Tax Lien Investing Can Provide the Following

Low Risk Annual Returns – State Annual Returns:

| Alabama 12% | Louisiana 17% Year 1 12% Thereafter |

| Arizona 16% | Maryland 10% to 14% |

| Colorado Prime rate + 9 points | Mississippi 18% |

| Connecticut 18% | Missouri 10% |

| Florida 18% | Montana 10% |

Georgia 20% Year 1 10% Year 2 | New Jersey 18% PLUS 2% to 6% Bonus |

| Illinois 18% to 24% | Nevada 12% |

| Nebraska 14% | Oklahoma 8% |

| Indiana 10% to 25% | Rhode Island 10% to 16% |

New York 10% to 14% and Bulk Sales of Liens | South Dakota 12% |

| Iowa 24% | South Carolina 8% |

| Kentucky 12% | Tennessee 10% |

| West Virginia 12% | Wyoming 18% |

Washington D.C. 12% (Each 6 month period) | |

This System is Designed to Walk You Through the Investment Process from Start to Finish!

Full Emphasis on Reducing and Managing Risk!

I will guide you down the right path by providing you with a simple Step-by-Step approach which

Uses SIMPLE AND ESTABLISHED LEARNING METHODS to make sure you learn and master the material!

Gives you PRECISE ANALYSIS OF YOUR INVESTMENT STATE, its trends, timelines, filing requirements and traps…in PLAIN ENGLISH!

Discusses the FULL SPECTRUM OF ALL RISK ISSUES: including economic risk, legal risk, and asset protection issues. Step-by-step instruction is given on how to reduce these risks!

Provides you with a STEP-BY-STEP ACTION PLAN to walk you through the necessary steps for mastery of the tax lien certificate investment process!

Investing in tax lien certificates is an area that is greatly influenced by state law and general legal rules. I understand this process from numerous angles. I am not just an investor with another book to sell. Rather, I am a licensed attorney and former consulting professional who has seen many sides of the process. First, as a successful investor, second as a real estate attorney, and third as a former business consultant to the Harris county property tax office.

I designed and wrote this course myself and I stand ready to help you. If you have any questions or concerns email us at: wealthtraininghelp@gmail.com

Why Is This System So Unique?

Attorney’s Secrets To Investing in Tax Lien Certificates™ is different not only because it contains straightforward legal and economic analysis, but because it uses simple and well-established learning methods to help you learn the material quickly and with a greater rate rate of retention. One advantage you will find integrated throughout this product is:

# 1) Context-Based Learning:

Context-Based Learning allows you to learn by DOING not just reading or listening! |

|

# 2) Extensive Coverage of Legal and Risk Issues:

Extensive Coverage of Risk Issues and the Exact Steps Required to Minimize Risk |

|

Reducing risk is a very important aspect of any investment technique. I am amazed and sometimes troubled when I review real estate courses which spend 80% of the materials covering the positive aspects of the investment technique yet they devote so little time to the negative aspects. To me that is a fluff product and a waste of money and time.

I always demand to know what could go wrong and why. I want to know where the pitfalls are, the unsettled areas of law, and the drawbacks. I devote approximately 50% of this tax lien certificate guide to risk issues and their avoidance. If you want a technical, real-world, nuts and bolts product without the marketing fluff then you will be very happy with this product.

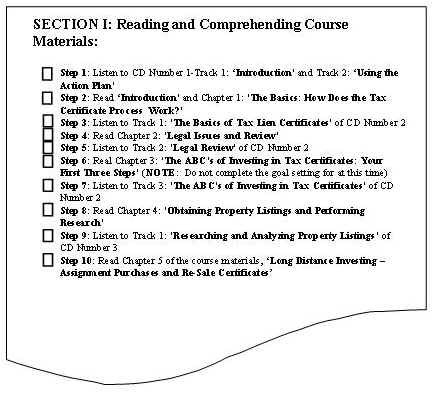

#3) An Action Plan to Guide You Through the Material In Precise Order To Maximize Your Learning:

|

|

The real challenge to investing in tax lien certificates comes when trying to avoid the various state deadlines and hidden traps which can hinder the inexperienced investor. My goal has always been to take my students beyond the basics. You will find much detail in my materials. I am determined to provide my customers the highest levels of training and all the details I know. I can’t forget the empty feelings I felt when I purchased courses that delivered far less than promised: I will break that cycle!

Here is a sample of what Attorney’s Secrets To Investing in Tax Lien Certificates™ will cover for you in the written course book and CD audio materials:

An Overview of the Tax Lien Certificate Investment Process: What Do You Really Need to Know?

What is the Difference Between a Tax Lien and a Tax Deed? What are the Rights and Responsibilities Associated with Each?

What is the Psychology of Investing in Tax Lien Certificates: What Do You Need To Know to Be Successful?

What Are the Primary Benefits of Tax Lien Certificate Investing?

How Do Counties Prepare for the Tax Sale? What County Procedures are Used to Prepare for the Sale? (state specifics are discussed in the state sections)

How is the Purchase Price of Tax Liens is Generally Computed (state specifics are discussed in the state sections)

What are the Different Types of Bidding Systems? (state specifics are discussed in the state sections)

Legal Rights of the Tax Lien Certificate Purchaser (state specifics are discussed in the state sections)

How Do the Interest Rate and Redemption Time Period Affect My Return on Investment?

What is Redemption and How Does it Work?

How Does the Delinquent Taxpayer Redeem the Tax Certificate? (state specifics are discussed in the state sections)

What Happens if the Delinquent Taxpayer Fails to Redeem?

What are Liens and Encumbrances?

What is a Voluntary Lien? What is an Involuntary Lien? What is an Automatic Lien? How Can These Liens Affect Your Investment?

History of Foreclosure and What it Teaches Us Today

What is the Legal Basis of Foreclose? (…in plain English)

The Basics of Lien Priority and How to Determine the Priority of Liens

What are the ABC’s of Investing in Tax Lien Certificates?

How to Assess Your Most Valuable Resource: Your Time

How to Assess Your Capital: Money

What is the Best Way to Set Goals When Investing in Tax Lien Certificates?

The Best Way to Select States for Investment

When Should Foreclosure Rules Affect Choice of Investment State?

11 Criteria You Must Consider Before Choosing a State to Invest in

Targeting Counties According to Size: The Rules You Must Follow

5 Instances When You Should NEVER Call Counties

What County Officials Won’t Tell You

The Side of Tax Lien Certificates that County Officials Never See: Be Warned!

4 Things You Must Know About County Employees Before You Make Contact

19 Questions that You Should Answer Before Considering An Investment State

4 Questions You Should Never Ask a County Official/Employee About Investing in Tax Lien Certificates

How To Obtain Tax Sale Listings From a Variety of Sources

How to Understand Tax Sale Listings and the 3 Hidden Clues You Must Look For

The Truth About Accessed Value and When to Use It

How to Use the Large Auction Environment to Your Advantage

How to Filter Liens Using the Barazandeh Methodä

When Should You Invest in Liens Secured by Residential Property

How To Verify You Are Looking at a Lien on a Residential Property

What Are the Advantages and Disadvantages of Liens Secured by Residential Property

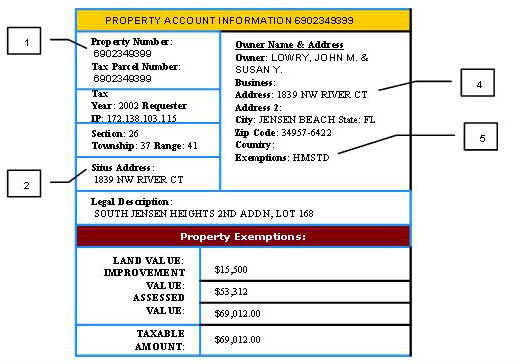

How to Navigate an Appraisal District and Tax Assessor Online Search Capabilities (contains actual Screen Shots)

How to Determine if the Lien Presents an Inadequate Security Risk?

What is Land Value Analysis? What Does the Formula Tell Us? What Are Its Limitations? When Should You Pass on a Tax Lien Certificate?

How to Double-Check Your Analysis of Land Value

Sample Phone Scripts with County Employees Relating to Land Value Analysis

What 5 Areas Should You Always Verify with the County?

When is Internet Research not Enough?

What is the Loan-to-Value Ratio Analysis and When Should it Be Used?

What Loan-to-Value Ratio is Acceptable? What Loan-to-Value Ratio is Unacceptable?

When Should You Use a Realtor?

15 Questions You MUST ask a Realtor

How to Work With a Realtor When Out-of-State

16 Key Questions You Must Ask Yourself When Viewing a Property

How to Invest From Anywhere in the World: The Steps You Must Take to Reduce Risk

What is ‘Assignment Purchasing’? (state specifics are discussed in the state sections)

What are ‘County-Held’ Certificates? (state specifics are discussed in the state sections)

How Do You Determine What Re-Sale Process is Available? (state specifics are discussed in the state sections)

Sample Phone Scripts with County Employees Relating to Assignment Purchasing

Subsequent Sales: The Truth and Risks

When Do Third Party and Absentee Bidding Work for the Investor?

What are the 11 Things You Must Know About Absentee and 3rd Party Bidding?

What Are the 5 Additional Due Diligence Steps You Must Take If You Want to Purchase Tax Liens From Out-of-State?

What is the Most Important Lesson You Can Learn About Appraisal Value?

How Do You Register for a Tax Certificate Auction? (state specifics are discussed in the state sections)

4 Things You Should Deduce From Every Tax Sale Calendar of Events?

What Documentation is Needed To Bid at Tax Lien Certificate Auctions? (state specifics are discussed in the state sections)

Key strategies for: Bid Up Auctions, Interest Bid Down Auctions, Share of Ownership Auctions, and Rotational Bidding Auctions

Due Diligence and Risk Reduction:

What is Due Diligence? What is ‘True’ Risk Reduction?

Which Liens Will Survive Foreclosure of the Tax Lien? (state specifics are discussed in the state sections)

What Interests Will Survive Tax Foreclosure? (state specifics are discussed in the state sections)

What is the ‘Inadequate Security’ Scenario?

What is an Easement in General?

What is an Easement Appurtenant?

What is an Easement in Gross?

What is a Land Covenant? How Do You Check for Overly-Restrictive Land Covenants?

How Do You Search for Easements? How Do You Know if an Easement is Public or Private?

What is a City Restriction? How Can it Affect Your Investment?

What are the Exact Steps Required to Search for City Restrictions?

What are Subsequent Taxes? When Will Subsequent Taxes Harm Your Investment? (state specifics are discussed in the state sections)

What are the Exact Steps Required to Subsequent Taxes Restrictions? (state specifics are discussed in the state sections)

When Will Subsequent Taxes Increase Your Profit? When will They Increase Your Costs? What are the Exact Steps Required to Search for Subsequent Taxes?

What is a Federal Tax Lien? What are the Exact Steps Required to Search for Federal Tax Liens

What Happens if You Foreclose on a Property with an Existing Federal Tax Lien?

When Can the Federal Tax Lien Undergo Redemption? What is the I.R.S. Policy on Federal Tax Lien Redemption?

What Happens When a Lender Suffers Financial Difficulty?

What are FDIC and RTC Held Liens? Why Should You Avoid Purchasing FDIC and RTC Held Liens. NOTE: ‘FDIC’ stands for Federal Deposit Insurance Corporation and ‘RTC’ stands for Resolution Trust Corporation.

What are the Exact Steps Required to Avoid Buying FDIC and RTC held Liens?

What is Environmental Liability?

How Do You Avoid the ‘Owner/Operator Liability’?

What is the Superfund Act and What Does Section 42 U.S.C 9601 Mean to the Tax Lien Certificate Investor?

What is the False Lure of Commercial Properties? What is a Phase I Environmental Inspection? What is a Phase II Environmental Inspection?

What Are the Risk Issues Associated with Commercial Property?

What Must Every Tax Lien Investor Know About Bankruptcy?

Precise Legal Quick Facts Review of Bankruptcy Law (…in Plain English!)

What Are the Goals of Bankruptcy?

What Are the Specific Steps Required to Check for Bankruptcy?

What is a ‘Preferential Transfer’? Who is the Bankruptcy Trustee? How Do You Avoid the Risk of Bankruptcy?

3 Things Every Tax Lien Certificate Investor MUST know about Bankruptcy!

What is the ‘Automatic Stay’? Can the ‘Automatic Stay’ Be Lifted?

How Do You Access Bankruptcy Records?

What Are the Exact Steps Needed to Manage Bankruptcy Risk?

What is Personal Liability Protection?

What is the Biggest Risk Facing Investors Today?

What is a ‘Defacto Business Entity’? What is a Formal Business Entity?

What is a Corporation and When Can It Assist You as a Tax Lien Investor?

What is a Limited Partnership? What is a Limited Liability Partnership?

What is a Limited Liability Company and When Should it Be Used by the Tax Lien Investor?

Foreclosure and Property Management:

What is the Foreclosure of a Tax Lien? What does it mean legally?

How Can ‘Due Process of Law’ Affect Foreclosure of a Tax Lien?

What Are the Hidden Traps of Foreclosure?

What are the Exact Steps Required to Foreclose Your Tax Lien? (state specifics are discussed in the state sections)

How Does the Lien Holder/Attorney Foreclosure Process Work? (state specifics are discussed in the state sections)

How Does the Lien Holder/Administrative County Process Work? (state specifics are discussed in the state sections)

What is a Suit to Quiet Title? What are the Exact Steps Required to Quiet Title?

When is a Suit to Quiet Title Required for Tax Lien Properties? (state specifics are discussed in the state sections)

When is the Suit to Quiet Title Not Required? What is the Cost of Suit to Quiet Title?

How Do You Select An Attorney for Your Legal Matters? How do You Select an Attorney for You Quiet Title Lawsuit?

15 Questions You Must Ask An Attorney?

How Can You Make Money on Your Tax Sale Property?

How Do You Manage Tax Sale Property? What is the First Thing You Must Do When You Receive Your Tax Deed?

How Do You Know When To Handle Insurance? When Has Possession and Legal Responsibility Passed?

How Do You Handle Occupants of the Property? How Do You Put Yourself in Possession? (state specifics are discussed in the state sections)

Legal Review of Ejectment Actions: What is an Ejectment? What is an Unlawful Detainer?

Do You Need An Attorney to Handle Ejectment? (state specifics are discussed in the state sections)

How Do You Sell Tax Sale Acquired Property?

What Are the 5 Key Techniques Used By Investors to Profit From Tax Sale Properties?

What is a Quick Sale? How To Price a Property Aggressively? How Do You Price a Property for a Quick Sale?

What is Creative Real Estate? What are the Core Creative Real Estate Selling Techniques?

How Do You Manage Repairs on a Tax Sale Property? How Do You Estimate Repairs?

Sample Repair Estimate Price Sheet and Simple Techniques to Rank Repairs and Save Money

Key Suggestions You Must Follow Whenever You Hire a Contractor

What are the ‘Big 3’ Considerations When Choosing a Contractor?

What are the Contractor’s Insurance, Bonding, and Licensing Requirements?

13 Questions You Must Ask a Contractor Before Hiring Them?

What is Property ‘Wholesaling’? How Does it Work?

What Special Considerations Exist for Tax Sale Acquired Property?

Sample Ads to Advertise a Property for a Quick Sale

How Do You Screen ‘Wholesale’ Buyers to Eliminate ‘Time Wasters’?

How Can You Tell Who is Wasting Your Time and Who is Serious?

What is a Lease Option? How Does a Rental Credit Work in the Lease Option Agreement?

How Can a Lease Option Reduce Rental Headaches?

What 3 Clauses Must Be Present in Every Lease Option Contract?

What are the Key Disadvantages of Lease Options?

How Do You Avoid the Equitable Mortgage?

What is the Installment Contract Sale Method? What are the Advantages and Disadvantages of Using the Installment Contract?

How Do You Rent the Tax Sale Property?

AND MUCH, MUCH MORE!

Investing in tax lien certificates can be done with part-time effort. You can purchase liens even if they are not sold by your home state. As an out-of-state investor you will need to follow the additional due diligence techniques described in Chapter 5 of the course, titled: Long Distance Investing. I will show you how to make this work.

|

Lastly, I realize no matter how well a course is written there will be times that you need to speak to a real person and ask questions. Although I mentioned this earlier, I think it is very important to assure you that when you purchase this product I will answer your questions via email for as long as you own the course. I believe that as a customer you deserve to speak with the author of the product at anytime. In fact you can email me whenever you like.

Some people choose to call me and talk to me personally even before they purchase the course. In fact, if you have any questions or concerns about this course or using these techniques from your state then contact me: 713-961-1134.

ORDER TODAY AND RECEIVE:

![]() Attorney’s Secrets To Investing in Tax Lien Certificates – Contains over 240 pages of Step-by-Step insider’s information on investing in Tax Lien Certificate Sales. Includes all aspects of purchasing tax lien certificates: finding liens, research and selection of liens, purchasing liens, foreclosure of tax liens, risk avoidance, selling tax sale properties and much more.

Attorney’s Secrets To Investing in Tax Lien Certificates – Contains over 240 pages of Step-by-Step insider’s information on investing in Tax Lien Certificate Sales. Includes all aspects of purchasing tax lien certificates: finding liens, research and selection of liens, purchasing liens, foreclosure of tax liens, risk avoidance, selling tax sale properties and much more.

Includes legal and Investment Analysis Sections for 21 Tax Lien Certificate States – A 170 page fully detailed analysis of each investment state, the investment climate, unfavorable laws, filing deadlines, foreclosure rules, tax sale registration rules, and more. Every area of each investment state is discussed and covered in full detail with specific statutory references. ![]() The Full Audio CD Guidebook With 6 Hours of Detailed Instruction – Includes 6 Audio CD’s with a total run time of approximately 4 hours. Contains valuable insight from Mr. Barazandeh covering the legal procedures associated with investing and his valuable easy-to-follow research techniques. You should listen to the CD’s after reading each chapter of the course book.

The Full Audio CD Guidebook With 6 Hours of Detailed Instruction – Includes 6 Audio CD’s with a total run time of approximately 4 hours. Contains valuable insight from Mr. Barazandeh covering the legal procedures associated with investing and his valuable easy-to-follow research techniques. You should listen to the CD’s after reading each chapter of the course book.

Important: The CD’s are not summaries! They test your understanding of the core concepts presented in the course and expand your knowledge.

![]() A Detailed 7 Page Action Plan with Quick Start Discussion – A simple and painless step-by-step action plan designed to take you from education to action by following our proven process.

A Detailed 7 Page Action Plan with Quick Start Discussion – A simple and painless step-by-step action plan designed to take you from education to action by following our proven process.

The Action Plan includes review questions and 3 practice sessions. It is your guide through the entire process. After you complete the materials the Action Plan is NOT over! It will continue to guide you through all of the required steps needed to make your first purchase and track your liens.

![]() Access to Our Online Research Center – Our Tax Lien Research Center will allow you to consolidate your county research into one place. There is no confusing registration requirement and no passwords to lose or forget. It is simple and designed to let you research your tax liens with minimal hassle and maximum efficiency.

Access to Our Online Research Center – Our Tax Lien Research Center will allow you to consolidate your county research into one place. There is no confusing registration requirement and no passwords to lose or forget. It is simple and designed to let you research your tax liens with minimal hassle and maximum efficiency.

As a professional I stand behind the quality of this product and I am grateful for the opportunity to share the knowledge I have gained in my years of learning, investing and consulting on this process. If you have any questions for me then please contact me personally at 713-961-1134 |

We offer a Full Risk Free 100% Satisfaction Guarantee

For a Full 30 Days!

The Best Program is Now Even Better – More States Added!

Customer Nancy Tryon:

“Thank you…your work is a necessity…”

Questions? Then, call us toll free at: 1-888-968- 8654

(product can be removed later)

Price: $249.95

Warmest Regards,

Darius M. Barazandeh, President

Attorney at Law / M.B.A.