Incorporate for Wealth:™ Attorney’s Corporation

Secrets!

By Darius M. Barazandeh, Attorney at Law / M.B.A.

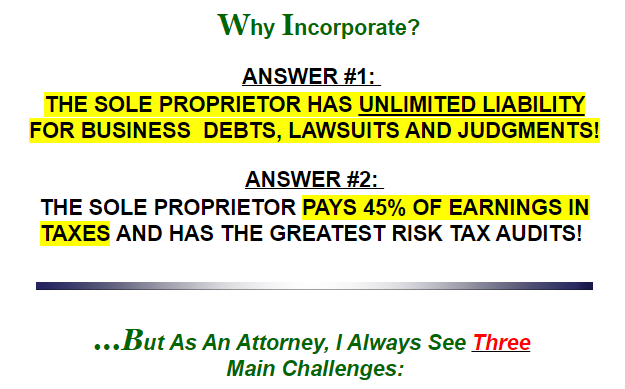

Challenge # 1: Many small business owners do not operate as a corporation or other business structure. A ‘dba’ or ‘name registration’ is NOT a business structure. As a result, many small business owners face wide open,100% liability from their business activities and pay additional taxes!

Challenge # 2: Even if you have a corporation, most small business owners DO NOT have instruction on how to create required records, conduct ‘proper’ meetings, maintain bank account controls and/or keep up with the required formalities. In fact, we have isolated 29 common errors that business owners make which create liability and destroy corporate protection! Do you know what these errors are?

Challenge # 3: An attorney or incorporation service can set up a corporation BUT 95% of the time the business owner is left with a stack of papers and little instruction! Very rarely is complete, step-by-step instruction given on how to maximize tax savings, choose the best tax structure, and preserve corporate status:

THE LAWS OF ALL STATES ARE CLEAR: If records of key meetings, business decisions and particular ‘formalities’ are not kept, the corporation is WORTHLESS in a lawsuit. This means full personal liability in a lawsuit!

Did you know that most people who contact an attorney or tax accountant generally won’t have a true two sided discussion! After all, its nearly impossible to ask the right questions and comprehend all your options unless you fully understand the choices and variations available. Its no wonder that most business owners are paying thousands ($1,000’s+) and thousands ($1,000’s+) of dollars in extra taxes each year!

Of course, attorneys and accountants can help with specific matters in your business but at hourly rates of $150 to $200 per hour…this can get very expensive! Very few people can afford to have their attorney walk them through every detail on how to r-u-n and m-a-n-a-g-e their corporation. As a result, mistakes are made and protections are lost!

As a result, most people conduct their business and make decisions without proper instruction!

TAKE CONTROL:

Imagine owning a reference guide that you can pull out, use and then get back to business!

Now imagine trying to piece all the answers together yourself.

Mistakes = lost revenue and liability

Ask Yourself This Question:

How Many Hours ($$) Would it Take for Your Attorney or Your Accountant to Create the Forms and Fully Instruct You On:

The proper documentation and steps required to AVOID the 29 (TWENTY NINE) common MISTAKES that frequently DESTROY corporate protection (includes real world examples, required forms and easy-to-follow instructions)

The LOST ART of CREATING ‘ROCK SOLID’ Corporate PROTECTION (includes real business examples, required forms, DVD Video explanations and easy-to-follow instructions)

The Complete STEPS required to FORM a CORPORATION in ANY STATE (forms, web links, state-by-state rules, and tips to avoid hidden traps are provided in EASY-TO-FOLLOW STEPS)

THE 16 STEPS that MUST BE COMPLETED within 30 DAYS of FORMING the Corporation (includes detailed instruction and forms)

KEY DIFFERENCES between C-corporations and S-corporations that will SAVE YOU THOUSANDS OF DOLLARS (includes real world examples, business situations and the end result on your profits)

EXAMPLES of WHEN your business may NEED to be taxed as an S-corporation and when it may NEED to be taxed as a C-corporation

The ONE PAGE YOU MUST INCLUDE in your BYLAWS and why it COULD SAVE YOUR BUSINESS!

WHY CORPORATE MEETINGS are NOT ENOUGH for FULL ASSET PROTECTION

The FORMS, CHECKLISTS and ADDITIONAL STEPS that 95% of business owners fail to complete when they form an S-corporation (includes required forms and instructions

The 4 TRUTHS that you must know about Nevada LLC’s (which Nevada promoters usually don’t tell you about!)

The 5 ADVANTAGES of Delaware LLC’s and when you should consider a Delaware LLC!

A REAL LIFE example of when an OUT OF STATE Corporation is an ADVANTAGE

The STEPS that MUST BE TAKEN to AVOID IRS treatment as a personal holding company and a personal service corporation. YOU MUST UNDERSTAND THESE TRAPS to AVOID THEM!

The VALUE of OPTIONAL provisions that YOUR ATTORNEY OR INCORPORATION SERVICE MAY forget to USE: cumulative voting, indemnification rules, staggered effective dates, and preemptive voting rights!

WHAT the BYLAWS are and why they SO IMPORTANT

Complete Sample BYLAWS with FULL AUDIO DISCUSSION OF EACH PROVISION and WHAT it MEANS for your BUSINESS! (includes full bylaws and required consent forms)

THE KEY SITUATIONS when you SHOULD INCLUDE INDEMNITY RULES in YOUR BYLAWS (includes clauses and a detailed discussion on when to apply)

HOW TO DETERMINE if the BYLAWS provided by YOUR ATTORNEY or INCORPORATION SERVICE OFFER FULL PROTECTION for you! (full audio discussion)

STEP-by-STEP instruction on HOW TO HOLD the REQUIRED FIRST MEETING of the Corporation, including COMPLETE FORMS and DOCUMENTS with written and AUDIO INSTRUCTIONS (a properly held first meeting is essential for corporate protection!)

Understanding Corporate STOCK: Par Value Rules, Share Restrictions, Cumulative Voting, Preemptive Voting Rights, Proxy Voting, Stock Buy Back Agreements, and Stock Valuation Techniques

THE STEP-by-STEP procedures of ISSUING STOCK – with EXAMPLES (includes detailed instruction and forms)

WHEN corporations NEED stock share RESTRICTIONS (includes sample forms and restrictions)

SAMPLE STOCK SHARE RESTRICTIONS with FULL EXPLANATIONS (includes detailed instruction and forms)

WHY EVERY corporation MUST have a BUY BACK AGREEMENT

COMPLETE FILL-IN BUY BACK AGREEMENT with FULL AUDIO EXPLANATION of all PROVISIONS (I will walk you through the MOST important tool for any stock corporation: THE BUY BACK AGREEMENT)

WHAT YOUR ATTORNEY MAY FORGET to GIVE YOU: (Includes spousal consent forms and fully describes when and why they are critical)

WHEN SHOULD the corporation issue STOCK UNDER IRC SECTION 1244?

WHY YOUR S-CORPORATION must use a SHAREHOLDER AGREEMENT! (sample agreement with full instructions is included)

THE 8 THINGS YOUR Corporation MUST DO WITHIN ONE MONTH of INCORPORATING! (with detailed instruction and forms on completing these tasks)

THE 4 THINGS EVERY Corporation MUST DO EACH YEAR after INCORPORATING! (includes detailed instruction and forms)

The LITTLE KNOWN and OFTEN FORGOTTEN RULES of corporate MEETINGS (includes specific tests for when rules apply)

STEP-by-STEP instruction on HOLDING YEARLY CORPORATE MEETINGS and COMPLETE FILL-IN FORMS

THE 5 STEPS REQUIRED to HOLD DIRECTOR MEETINGS (includes forms and easy-to-follow instructions)

THE 5 STEPS REQUIRED to HOLD SHAREHOLDER MEETINGS (includes forms and easy-to-follow instructions)

Understanding Corporate TAXATION and how it will AFFECT YOUR BOTTOM LINE!

AVOIDING the hidden traps of Corporate TAXATION: PERSONAL HOLDING COMPANIES, ACCUMULATED EARNINGS PENALTIES, DOUBLE TAXATION, and others!

HOW TO COMPLETE ‘ROCK SOLID’ CORPORATE MINUTES: includes forms and instructions for the first organizational meeting, annual meetings of directors, special meetings of directors, annual meetings of shareholders, and special meetings of shareholders.

WHAT is a Corporate RESOLUTION? WHEN DO I NEED to COMPLETE ONE? (includes 50 sample resolutions and full instructions)

UNDERSTANDING the MOST COMMON yet almost forgotten art of CREATING Corporate RESOLUTIONS (detailed line-by-line instructions included)

Detailed STEP-by-STEP instruction on AVOIDING conflicts of interest (includes all forms and instructions needed to handle such a situation)

FULL DISCUSSION of taxation issues for the self employed, multi employee businesses and more! (includes detailed instruction, forms, comparisons and real world effects on your bottom line)

FULL DISCUSSION of TAX ISSUES for REAL ESTATE INVESTORS (includes detailed instruction, comparisons and real world effects on your bottom line)

ENDING YOUR CORPORATION and the TAX TRAPS you MUST KNOW ABOUT!

Priceless instruction from MR. BARAZANDEH on how to select a CPA compatible for your business and needs! This information could SAVE YOU THOUSANDS OF DOLLARS!

SIMPLE and PRACTICAL steps to handle your Corporate BOOK KEEPING and ACCOUNTING RECORDS!

ADOPTING HEALTH CARE benefits, RETIREMENT PLANS, GROUP LIFE INSURANCE and more! (includes forms and instructions)

How to Avoid Personal Liability TRAPS in Real Estate and other business activities (A common mistake made by owners of real estate and other public use property!) This is a FORGOTTEN MISTAKE THAT CAN COST YOU HUNDREDS OF THOUSANDS OF DOLLARS OR MORE!

and WE INCLUDE MUCH, MUCH MORE!

Ask Yourself:

Have you mastered all of these steps? Do you have someone who will explain all of this information to you? How much is reducing lawsuit risk, audit risk and saving taxes worth to you? What will it be worth AFTER A LAWSUIT OR TAX AUDIT?

Are You Confused About Tax Issues?

We Include SIMPLE, NON-COMPLEX Discussions of Corporation Tax Options and Traps!

…AND THE REAL WORLD EFFECT ON YOUR PROFITS!

Own the System Today!

I believe in keeping things SIMPLE and NON-COMPLEX. Many people complain that even after talking with their CPA they don’t fully understand their tax choices. I will SHOW YOU the real world effect each corporate tax choice has on your bottom line. I don’t believe in useless theory, so I will demonstrate how each choice can effect YOUR PROFITS! Plain and simple, easy-to-follow and with plenty of examples! Students always tell me, “My accountant could never explain this to me…it finally makes sense now!” (includes full discussion for real estate investors, and other businesses!)

I don’t believe in fluff or ‘one size fits all’ solutions…so you won’t find them here. This is a fully detailed system and includes state exceptions and variations, up-to-date legal decisions, court cases, IRS rulings, full explanations of tax decisions and state law summaries. Best of all this system is easy to understand and explains all topics, concerns, choices and situations in ‘simple and clear language’…NOT LAWYER TALK and NOT COMPLICATED!

What Will This System Do For Me?

We will provide you with certainty and high-level training! It is very clear from countless court decisions that filing your corporate paperwork is simply not enough. In each of the 50 states and the District of Columbia it is only when you r-u-n and m-a-n-a-g-e the corporation correctly, that a personal liability shield is created. In fact, we go WAY BEYOND corporate meetings and records, because there will be tax choices and liability traps throughout the life of your business. Wouldn’t you rather know what to WATCH for now? How many mistakes can you afford?

Incorporate for Wealth™ goes far beyond any other materials or services in this area. Many of these methods offer limited instruction, and don’t explain ‘HOW-TO’ TASKS’ in a clear ‘step-by-step’ manner. Others may cost much more than you think, for example:

Self-Help Books and Other Materials usually cover the basics of forming the corporation and devote little time to other issues. Incorporate for Wealth™ takes step-by-step instruction to another level and walks you through forming the corporation, management, conducting meetings, tax issues and choices, asset protection and liability reduction techniques. All of this is done in a step-by-step written form, with clear CD audio instructions and even DVD video instructions!

THAT’S NOT ALL: You will also have full email support from me: Darius M. Barazandeh, Attorney at Law / MBA. I have spent years coaching investors and business owners through these issues. I actually enjoy answering emails and hearing from you! You can be sure I am here!

Online and Other Incorporation Services will generally file basic corporate ‘paperwork’ for you and little else. Sadly, you won’t receive much instruction on what you do after you file the corporation’s paperwork! Even worse, in my experience these filings wind up costing much more than the original ‘quoted’ price. Many times the customer pays $400, $500 or more for just simple filing and little else! As a result you are left with a stack of papers and confusion!

Here’s the beauty of this system: You will use it not only during your first month or first year, but throughout the life of your business. Incorporate for Wealth™ is a valuable reference guide that you will use again and again and again.

Customer Service

That Will Make You Smile!

That is a promise! I know that you are too busy to deal with companies that don’t return emails, phone calls, or hand you off assistants who can’t answer questions. I hated this about home study systems.

If you have questions, then email us at: wealthtraininghelp@gmail.com

You will find tremendous detail in my materials. I am determined to providing my customers the highest levels of training and all the details I know. I can’t forget the empty feelings I had when I purchased materials that delivered far less than promised: I am absolutely committed to exceeding your expectations!

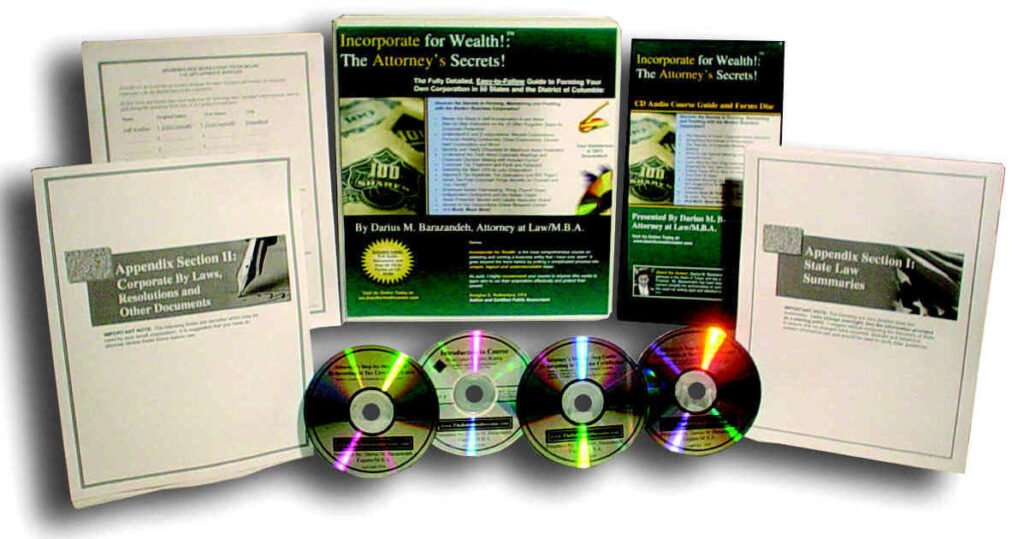

Order Today and Receive:

![]() Incorporate for Wealth™ Manual – A 296 page easy-to-follow complete guidebook with specific step-by-step details on corporate formation, specific exceptions for your state, key tasks to complete after incorporation, corporate meetings, tax decisions, asset protection issues and the latest liability reduction techniques.

Incorporate for Wealth™ Manual – A 296 page easy-to-follow complete guidebook with specific step-by-step details on corporate formation, specific exceptions for your state, key tasks to complete after incorporation, corporate meetings, tax decisions, asset protection issues and the latest liability reduction techniques.

Also included:

Detailed State Corporate Law Summaries for All 50 States and the District of Columbia – Includes state law summaries, a list of required corporation records, and other key information for your state. Also includes links and contact information.

![]() Incorporate for Wealth™ Audio Discussion and Instruction – Includes the most detailed and easy-to-follow audio instruction ever produced for corporations. I will walk you through easy step-by-step instructions on the special issues associated with corporate formation. The CD audio series will also discuss the required tasks to complete within the first 30 days and each year after formation, how to make management choices, corporate meetings, proper decision making, and a line-by-line review corporate bylaws and more!

Incorporate for Wealth™ Audio Discussion and Instruction – Includes the most detailed and easy-to-follow audio instruction ever produced for corporations. I will walk you through easy step-by-step instructions on the special issues associated with corporate formation. The CD audio series will also discuss the required tasks to complete within the first 30 days and each year after formation, how to make management choices, corporate meetings, proper decision making, and a line-by-line review corporate bylaws and more! ![]() Over 65 Fill-in Forms in Microsoft Word® and Hard Copy Format – Includes over 65 fill-in forms on CD-Rom and in written form. Includes all required resolutions, minutes of meetings, member contribution forms, independent contractor agreements, unanimous consent forms, stock share restriction agreements, spousal consent forms, tax forms, current IRS tax publications and more!

Over 65 Fill-in Forms in Microsoft Word® and Hard Copy Format – Includes over 65 fill-in forms on CD-Rom and in written form. Includes all required resolutions, minutes of meetings, member contribution forms, independent contractor agreements, unanimous consent forms, stock share restriction agreements, spousal consent forms, tax forms, current IRS tax publications and more!

ALSO INCLUDED:

![]() Customizable Corporate Bylaws with Audio Instructions and State Specific Exceptions – Includes a line-by-line review of corporate bylaws to help you understand how the bylaws work and what they should contain! Audio discussion corresponds to pre-formatted, ready-to-use, sample bylaws. Don’t miss this ‘mini’ seminar! Simply the most detailed training available anywhere!

Customizable Corporate Bylaws with Audio Instructions and State Specific Exceptions – Includes a line-by-line review of corporate bylaws to help you understand how the bylaws work and what they should contain! Audio discussion corresponds to pre-formatted, ready-to-use, sample bylaws. Don’t miss this ‘mini’ seminar! Simply the most detailed training available anywhere!

TO HELP YOU RUN YOUR CORPORATION:

![]() Access to Mr. Barazandeh’s Online Tutorial: ‘Finding the Law Yourself’– Designed to walk you through the tasks that most people forget: Understanding your state’s business corporation rules! This is a must have for the business owner!

Access to Mr. Barazandeh’s Online Tutorial: ‘Finding the Law Yourself’– Designed to walk you through the tasks that most people forget: Understanding your state’s business corporation rules! This is a must have for the business owner!

![]() 2 Years Unlimited Access to the Online Business Research Center – We have included online access to Secretary of State web pages for all 50 states and the District of Columbia. In addition, we have included access to your state’s corporation laws and other helpful state and federal website links.

2 Years Unlimited Access to the Online Business Research Center – We have included online access to Secretary of State web pages for all 50 states and the District of Columbia. In addition, we have included access to your state’s corporation laws and other helpful state and federal website links.

BONUS ITEM

(Yours to Keep FREE if you Return the Materials!)

![]() Corporation Lawsuit Protection Seminar Video – Specifically designed for the special requirements of corporations. Includes full discussions on liability reduction techniques, safeguards and methods. Includes discussion on insurance and other ‘hot’ issues for 2006!

Corporation Lawsuit Protection Seminar Video – Specifically designed for the special requirements of corporations. Includes full discussions on liability reduction techniques, safeguards and methods. Includes discussion on insurance and other ‘hot’ issues for 2006!

I look forward to working with you and OFFER and 100% RISK FREE MONEY BACK GUARANTEE if you are not satisfied with the materials. As a professional I stand behind the quality of these materials and I am grateful for the opportunity to share the knowledge I have gained in this area. If you have questions, then email us at: wealthtraininghelp@gmail.com. Let’s get started today!

Warmest Regards,

Darius M. Barazandeh, President

Attorney at Law / M.B.A.

Attorney, JIMMIE PHAGAN Said:

(click the Player to Listen):

“…I continue to be amazed at the depth and breadth of his knowledge, wisdom and experience…he genuinely cares about your success in life…in my opinion he is the complete package…”

Millionaire Real Estate Investor and Teacher Heather Seitz Recommend Darius:

Click the Movie to Listen: