Informed Investor Commentary:

Thursday 4/28/2011

Why a Crash Could be Coming…

I just wanted to share some of my thoughts on the economy, markets and how this affects real estate, the U.S. dollar, gold and silver, oil and your wealth. I am just sharing my thoughts and my opinions. DISCLAIMER: This is not investment advice but just a commentary on how I see things at this point and time. It could be right or wrong and my outlook could change.

NOTE to SUBSCRIBERS: We also are going to change the format our of newsletters to give you up-to-date information as we move into what I call the ‘wealth shift’ phase of the economy.

In this phase (which we have been in for at least 3 years now) you will continue to see the U.S. dollar decline substantially and inflation rise. This is hidden transfer or shift of wealth from ‘savers’ (people with savings) and the middle class (not mutually exclusive). As the cost of food, gas, services rise, the value of our money (U.S. dollar) is slowly being eroded. This ‘wealth shift’ phase will continue for the next 5 to 10 years. As the U..S. dollar devalues other assets will rise dramatically.

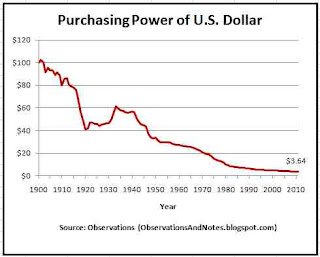

As you can see the dollar has declined substantially in the last 100 years. Approximately 20% of the purchasing power of our dollars have been lost in the last 10 years!

On Wednesday (4/26) the Federal Reserve chairman Ben Bernanke held a press conference. This was the first Fed press conference ever! Hopefully many of you already know that the Federal Reserve (the ‘Fed’) is NOT part of the U.S. federal government. It is a private central bank that has a quasi-corporate structure. The Federal Reserve is owned by private shareholders both domestic and foreign.

Takeaway from the Fed Press Conference:

Bernanke indicated that the Fed would leave rates unchanged until the end of its stimulus program. This program is referred to as ‘quantitative easing’ or QE. QE2 is still scheduled to end June 30th, 2011. The effects of QE2’s end should concern us all.

How this Affects You:

Interest rates: The Fed has kept rates at essentially 0 percent. This has been done to increase the velocity and liquidity of money. It appears that the Fed will keep rates low for a while. We might see a rise on June 30th after QE2 ends.

Gas Prices: Gas prices will probably continue to rise. The rising gas prices are a function of the decline in the dollar, demand and supply lines. I believe they are more a function of the dollar decline and OPEC than anything else. Look at this this way: Essentially, one gallon of gas is still one gallon of gas. However it takes more dollars to buy that gas because each dollar is worth less. The Fed’s ‘loose money’ policy will continue to devalue the dollar in the coming months. Requiring you to put out more dollars for the same gallon of gas. Its called ‘inflation’.

Stock Market: The stock market continues to gain. I believe this is an illusionary bubble that will deflate when the Fed begins to end its QE ‘stimulus’ programs. I would consider moving out of pure equities unless they are tied to the commodities market. For example, during times of high inflation (like the 1970’s) stocks or commodities linked to oil, gas, gold, silver, food and other ‘tangibles’ go up. We could be in a very similar place today.

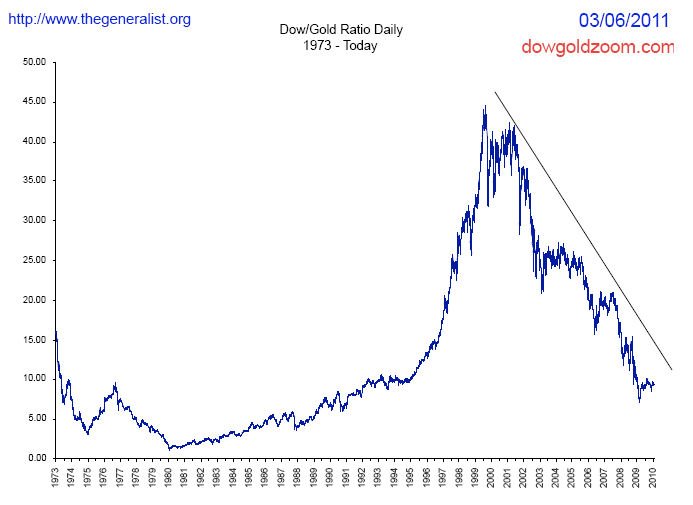

For example here is the Dow Jones Industrial average up to today:

You can see that there is a decline when you ACTUALLY price this market in terms of REAL things like gold, oil, etc. The reason is that the purchasing power of money during an inflationary time goes down. Price can go up (like the Dow) but in terms of real money the market is down.

I know that may sound confusing but in later articles I will explain more.

Consider this: Stocks may be rising the but the dollars you get from selling those stocks continues to buy you less and less. This results in a LOSS OF WEALTH. This is what I call the ‘Wealth Shift Effect’.

Gold and Silver: Gold and silver are now at record highs. This happened during the 1970’s and culminated in 1980. Silver hit around $50/oz. and gold peaked at around $825 to $850/oz.

Today gold is topping $1,500/oz. and silver is over $48/oz. Notice that silver is still below its 1980 high. Can you name any other assets you can buy at a price cheaper than its 1980 high?

I will have more information coming as we move closer to the full apex of this ‘Wealth Shift’ paradigm. However I still believe that gold and silver will be the PRIMARY assets for wealth preservation during this decade. I also believe that we could see $250/0z. silver and $5,000/oz gold. However, I also think we will see some significant price drops along the way.

Make no mistake: Silver and gold are again gaining massive purchasing power during this ‘wealth shift’. In other words, these vehicles will likely increase exponentially in value as paper money, debt instruments, bonds, indentures, and other ‘paper assets’ continues to decline.

Can the Fed Raise Rates High Enough to End Inflation?

I don’t believe the Fed will raise rates high enough to stop inflation and the weakening dollar in June. Remember that the Fed funds rate is now at 0%. The Fed would have to raise rates at least 4 basis points above the ‘real inflationary rate’ to quell inflation.

The real rate of inflation is around 7 to 10%, despite the 3% inflation rate Washington is claiming. See – John Williams Shadow Stats: (http://www.shadowstats.com/alternate_data/inflation-charts)

Assuming inflation at 10% the would have to raise interest rates 4% over the real inflation rate to slowly stop this inflationary bubble. If the Fed rasises rates to 14% this would be disastrous to our economy and the national debt load. Also Paul Vocker did this in 1980 almost overnight. It took 2 years to slow down inflation. So how long will inflation be around – a while.

High interest rates will make our national debt payments each year much higher. Consider this: around 20% of Treasury debt is due every 4 years. This means 20% of our treasuries re-cycle and will adjust with higher interest rates. The debt burden with 14% rates would be crushing. So inflation will get a lot worse.

Alright, so what does this mean to me?

Here are a few points to consider. I will have more updates as we move deep further into the ‘Wealth Shift’ economy:

1) Inflation will continue to erode the purchasing power of the dollar. Buy extra food and household items when you can because its a savings to you now.

2) If the Fed ends QE2 June 30th 2011, we could see a substantial decline in the stock market. Plan accordingly. Please read this article: http://www.markatch.com/story/2008-crash-deja-vu-well-relive-it-and-soon-2011-04-26?pagenumber

3) Gold and Silver may also drop substantially during this time. For many of us this represents a big buying opportunity. I will keep you up to date on what I am doing and how I am buying. Again, this is just my own commentary on what I am doing. This is NOT INVESTMENT ADVICE.

4) Real Estate: I see real estate hitting a double dip. Real Estate in many markets is still way above the 100 year Case Shiller Index. This means that values are still inflated and will come down further. I would not acquire property unless you can get it really cheap (50% of FMV) and its located in a stable area that is good for rentals. Because of the foreclosure levels, droves of people are now renting. However, the area you choose for rentals must have a good job outlook -so choose carefully.

5) Short term Real Estate: I still like wholesaling for cash generation. Very low risk and countless properties are changing hands. Why not earn some money on this?

6) Price of Gas: I think we will see gas continue to rise as we move into the summer months. If we see riots and regime change in Saudi Arabia then prepare for a HUGE jump in prices. One fund that I have been investing in is: United States Gasoline Fund. (ticker: UGA). It tracks the price of gas and as gas rises you make money. Again this is just demonstrating what I am doing to preserve and grow wealth during this time NOT a recommendation for you.

NOTE: If we see regime change in Saudi Arabia then I will be issuing a special set of WARNINGS because this could mean the ‘Wealth Shift’ is set to speed up exponentially – MORE TO COME

7) Taxes: The U.S. is scrambling for cash and I would expect to see audits increase and taxes go up on the middle class (people like you and me). Make sure you have things set up correctly. If you need help take a look at this: http://www.theinformedinvestor.com/Wealth_BuildingLLC.htm

We are including our ‘audit proof’ presentation along with each purchase of the program. Also for 20% off just include the code at check out: APRIL

One last point: This ‘Wealth Shift’ will move slowly and then dramatically faster and faster. In other words as we move closer to 2012 and then 2013 the shift will move faster and faster. At some point it will move at almost unimaginable levels.

That means the inflation will rise quicker and the wealth moving into other assets will exponentially increase. Because of this we are going to be bringing you weekly updates and a new format and interactive website to continue to be your partner during this time.

I look forward to raising the standard of education again and again to help you maximize the ‘Wealth Shift’ effect that is going on. A handful of people (like you and me) are going to become very wealthily during this time. Many others will lose a huge part of their nest egg.

Let’s spread the word and save all those we can. Information and information sharing will be key during this time.

Much love and peace and May God Bless America!

Warmest Regards,

Darius M. Barazandeh, Attorney and Counselor at Law / MBA – Finance

P.S. – if you enjoyed this information write me back and let me know: taxenterprises@yahoo.com